When you obtain a loan with a balloon payment, it's crucial to understand the final lump sum you'll owe. To calculate your balloon payment, you'll need consider the loan amount, the APR, and the loan length. A basic formula can help you, but leveraging a online tool often provides higher accuracy.

Before your balloon payment becomes payable, make sure you have the resources ready to cover it. Failing to do so could lead to negative impacts on your credit.

Calculate Balloon Loan Payments

Taking out a balloon loan? Understanding your monthly payments is crucial. A balloon loan calculator helps you figure this out quickly and easily. By plugging in the loan amount, interest rate, term length, and payment frequency, you can see exactly how much you'll be responsible for each month. This knowledge empowers you to make informed decisions about your finances and ensure you can comfortably meet your monthly obligations.

Remember, balloon loans typically have lower initial payments compared to traditional loans. However, a large lump-sum payment, the "balloon," is due at the end of the term. Utilizing a calculator helps you plan for this significant payment and avoid any unforeseen expenses.

- Calculators are available online and through financial institutions to help you evaluate your balloon loan payments.

- Don't hesitate to discuss a financial advisor if you have any questions or need further clarification regarding balloon loans.

Explore a Balloon Mortgage: Leverage Our Calculator

Planning to obtain a home? A balloon mortgage might seem like an appealing choice. This type of loan offers low initial payments, however it culminates in a large lump-sum payment at the conclusion of the term.

To assess if a balloon mortgage is right for you, our convenient calculator can give valuable insights. It accounts for your economic situation to estimate monthly payments and the final balloon payment.

- Utilize our calculator to model various scenarios.

- Understand a clear picture of your potential monthly expenses.

Calculate Your Balloon Mortgage with Ease

Figuring out your monthly contributions on a balloon mortgage can seem intimidating, but it doesn't have to be! With a little bit of information and a few simple calculations, you can easily determine an estimate. First, gather the essential details: your loan amount, interest rate, term length, and payment frequency. Once you have these figures, utilize an online balloon mortgage tool or consult with a mortgage expert. These resources will guide you through the process and provide a clear picture of your potential monthly expenses. Remember, understanding your monthly commitments is crucial for budgeting and ensuring financial security.

Estimate Your Balloon Payment - Get Precise Results

A balloon payment calculator is a handy tool for figuring out the final, lump-sum payment due at the end of a loan term. These payments can be substantial, so it's crucial to grasp just how much you'll get more info owe. Using a calculator can help you project your future financial obligations and arrange accordingly.

A reliable balloon payment calculator will factor in key variables such as the principal amount, interest rate, loan term, and frequency of payments. By entering this information, you can obtain an accurate estimate of your final balloon payment.

It's advisable to use a calculator that offers different options. This allows you to explore the impact of varying interest rates or loan terms on your final payment.

Remember, being prepared about your balloon payment is essential for managing your finances effectively.

Mortgage Calculator with Balloon Payment Feature

Searching for a mortgage estimator that handles balloon payments? Look no further! Our innovative software delivers an user-friendly platform to calculate your monthly payments and overall cost. With our in-depth calculator, you can adjust the loan term, interest rate, and starting amount while incorporating a balloon payment at the finish of the loan term. Get a precise picture of your {financialcommitment and facilitate informed selections.

Romeo Miller Then & Now!

Romeo Miller Then & Now! Brandy Then & Now!

Brandy Then & Now! Jurnee Smollett Then & Now!

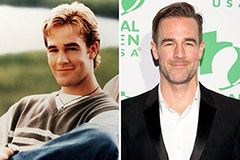

Jurnee Smollett Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now!